Knowing How to Gas Trading

Gas trading has become crucial in the commercial world in today’s dynamic energy market. Natural gas is a flexible energy source that powers companies, warms homes, and stimulates economic development. It is essential to maintain a steady and efficient supply of this fuel. In examining the realm of gas trade, this blog article clarifies the importance of this industry for businesses and the profitability prospects it offers.

Trading in gas includes purchasing and selling natural gas in various formats, including financial contracts, derivatives, and physical delivery. Underpinning the energy market it helps producers, suppliers, and consumers manage constantly variable prices and guarantee a consistent supply of this vital resource.

The Ecosystem of Gas Trading

It’s critical to understand the ecology that gas trading includes to appreciate the potential it presents fully.

- Trading in Physical Gas: Real trade in tangible natural gas. Gas is sold by producers to wholesalers or distributors, who then provide it to end users, such as business, residential, and industrial clients. Securing a steady supply of gas to power activities is what this entails for business companies.

- Financial Gas Trading: Financial instruments such as futures and options contracts are used in this kind of gas trade. Traders and investors may use these products to speculate on or protect themselves against potential changes in the price of natural gas. They provide an efficient means of managing pricing risk for enterprises.

- Spot Market: Natural gas is traded on the spot market for delivery instantly or in a limited time. Weather patterns, geopolitical developments, and supply and demand dynamics affect spot market prices. Businesses who want to purchase gas at a discount might benefit from spot market possibilities.

- Futures Market: Contracts for futures, which are exchanged on commodity exchanges, provide parties the option to fix prices for gas delivery in the future. This is especially helpful for companies that require long-term pricing stability for financial planning and budgeting.

- Market for Options: Options contracts provide flexibility by giving you the option—but not the duty—to purchase or sell natural gas at predetermined rates. Businesses might use options to bet on future movements or hedge against pricing volatility.

Why Trading Gas Is Important for Businesses

- Risk management: Gas trade offers useful instruments for managing business price risk. Because price changes may have a big effect on profitability, this is particularly important for companies that depend substantially on natural gas for operations.

- Cost Optimization: By engaging in active gas trading, companies may get gas supplies at favorable rates, cutting expenses associated with operations and boosting their marketability.

- Market intelligence: Gas trade enables businesses to make well-informed choices on their energy purchase plans by providing access to current market data and patterns.

- Profit Generation: It may be a source of extra income for businesses with experience in gas trade. Using a strategy of purchasing cheap and selling high might be profitable trading.

Handling the Gas Trading Environment

Commercial enterprises who want to be successful in gas trade should think about the following tactics:

Evaluate the risks associated with your exposure to variations in the price of natural gas and create a risk management plan that complements your company objectives.

- Diversification: To spread out your holdings and lower risk, investigate several facets of gas trade, such as the financial and physical markets.

- Market analysis: Keep current on factors affecting gas prices, such as weather patterns, geopolitical happenings, and market trends.

- Hedging: To protect yourself from market fluctuations and guarantee attractive gas purchase rates, consider using futures and options contracts.

- Regulatory Compliance: Ensure the laws and market guidelines governing gas trading are followed.

In Summary Of Gas Trading

The dynamic and diverse world of gas trade offers chances for cost reduction, risk management, and even business profit-making. Businesses may use the strength of this vital energy market to achieve commercial success in today’s competitive setting by comprehending the gas trade ecosystem and putting smart trading strategies into place. Gas trading is a useful tool for every business, whether you operate in an energy-intensive sector or are trying to save expenses.

Advantages

- Potential for Profit: Trading in gas can be very successful and provide substantial profits in cash. Pricing volatility may provide opportunities for astute traders to profit from shifts in the market.

- Vast Market: The market for trading gases is diverse and includes liquefied natural gas (LNG), natural gas, and other specialized gases. Because of this variety, traders may investigate many markets and identify chances in specialized areas.

- Global Reach: The gas trading industry is a worldwide one, enabling companies to grow and take advantage of opportunities abroad. This may result in more sales and a larger clientele.

- Energy Transition: Trading cleaner gasses and participating in the expanding market for sustainable and renewable energy are possibilities that arise as the globe moves toward cleaner energy sources.

- Risk management: Gas trading gives companies access to instruments for managing risk, such as options and futures contracts, which help them reduce possible losses and protect themselves against price swings.

Negative

- Market Volatility: Weather patterns, geopolitical developments, and other variables may significantly impact gas prices. Rapid and unforeseen changes in market circumstances may result from this volatility.

- Regulatory Difficulties: Several national and international restrictions govern the gas trade. Compliance with regulatory standards and evolving rules may be difficult and time-consuming.

- Costs associated with infrastructure: trade gas often necessitates large expenditures in infrastructure, such as platforms for trade, storage facilities, and transportation. For many companies, large upfront expenses might be a deterrent to entrance.

- Environmental Concerns: Carbon emissions, in particular, the environmental effects of gas trade, are coming under more and more attention. Companies may struggle to adapt their operations to changing environmental regulations and preferences.

- Dependency on External variables: Outside variables that impact gas trade include geopolitical conflicts, world economic circumstances, and technical breakthroughs. Uncertainties in the market may arise from outside factors.

It takes a systematic strategy to navigate the gas trading environment, considering the inherent dangers and the possible benefits of this dynamic and ever-evolving business.

Frequently Ask Questions About Gas Trading

How does gas trading work?

A: Trading in gases includes purchasing and vending several types of gases in different markets, including liquefied natural gas (LNG), natural gas, and other specialized gases. Traders engage in this financial activity to make money from changes in commodity prices.

How does trading in gas operate?

A: Buying and selling gas contracts is what gas trading entails for players like producers, suppliers, and dealers. Transactions on commodity exchanges or over-the-counter (OTC) markets often occur about these contracts, which may be based on spot or futures pricing.

What aspects of the economy affect gas prices?

A: Weather, economic indicators, geopolitical events, supply and demand dynamics, and regulatory changes are just a few of the variables that affect gas prices. To make wise trading choices, market players carefully monitor these variables.

How many distinct kinds of gases are traded on the market?

A: Natural gas, LNG, propane, butane, and other specialty gases are among the gases traded on the gas trading market. Different pricing factors, usage, and market dynamics drive each kind.

What advantages does gas trading provide to businesses?

A: Gas trading helps businesses exploit market possibilities, optimize their supply networks, and hedge against price volatility. Businesses may diversify their income sources and participate in the global energy market by selling gas.

What dangers come along with exchanging gas?

A: Market turbulence, legislative modifications, world events, and ecological worries are some risks associated with trading gas. To minimize possible losses, traders must use risk management techniques like hedging.

In gas trading, how can enterprises overcome regulatory obstacles?

A: Staying current on and abiding by national and international laws is essential. Businesses must have comprehensive compliance protocols, communicate effectively with regulatory bodies, and adjust to evolving regulatory environments.

Can small companies take part in the gas trade market?

A: Although gas trading often requires large infrastructure expenditures, smaller companies may nonetheless participate by concentrating on certain niche markets, forming partnerships, or entering joint ventures. Furthermore, firms may manage risk without making significant upfront expenditures using financial products like futures and options.

How does the switch to greener energy sources impact the trade of gas?

A: The global transition to greener energy sources impacts the gas trade. There are chances to trade cleaner gasses, participate in markets for renewable energy, and modify corporate plans to conform to changing environmental regulations and preferences.

How can companies control how trade in gas affects the environment?

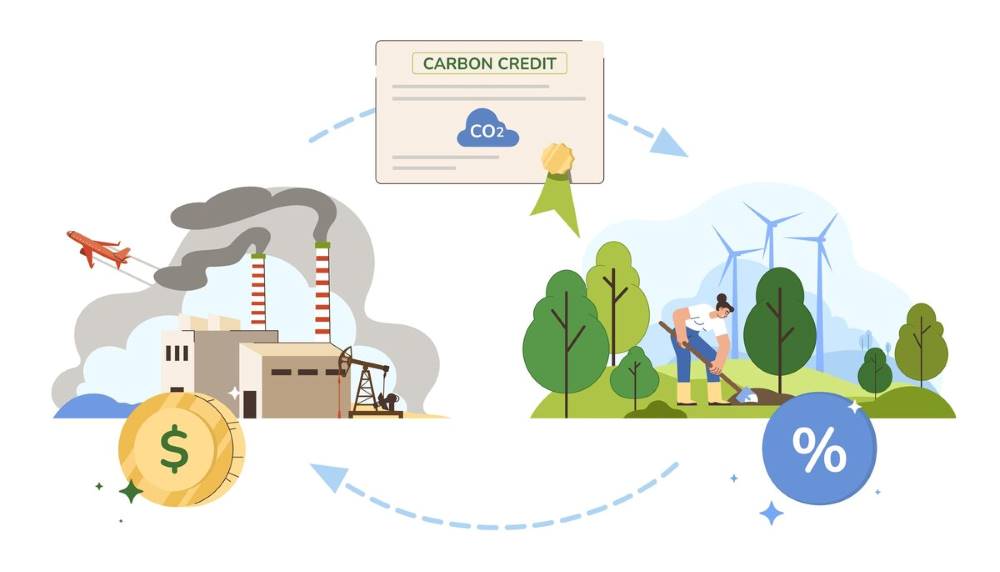

A: Companies may lessen the environmental effect of gas trade by implementing sustainable practices, investing in greener technology, and participating in carbon offset schemes. Businesses may improve their standing in the market by aligning with eco-friendly practices.

What support systems are available to companies wishing to join the gas trading industry?

A: Companies can access market data, participate in industry gatherings, and work with organizations. Financial institutions, commodities exchanges, and consulting companies are additional sources of knowledge and support for enterprises navigating the intricacies of the gas trade.